Bluehelix Technical Function Manual

Technical Principle:

At present, the transaction and interoperability demand for the native assets on the different public chains is rapidly growing in the current digital assets market (not limited to anchored assets). Therefore, cross-chain interconnection has become a very real demand. In this context, Bluehelix has actively innovated and accomplished cross-chain interoperability out of theory to practice.

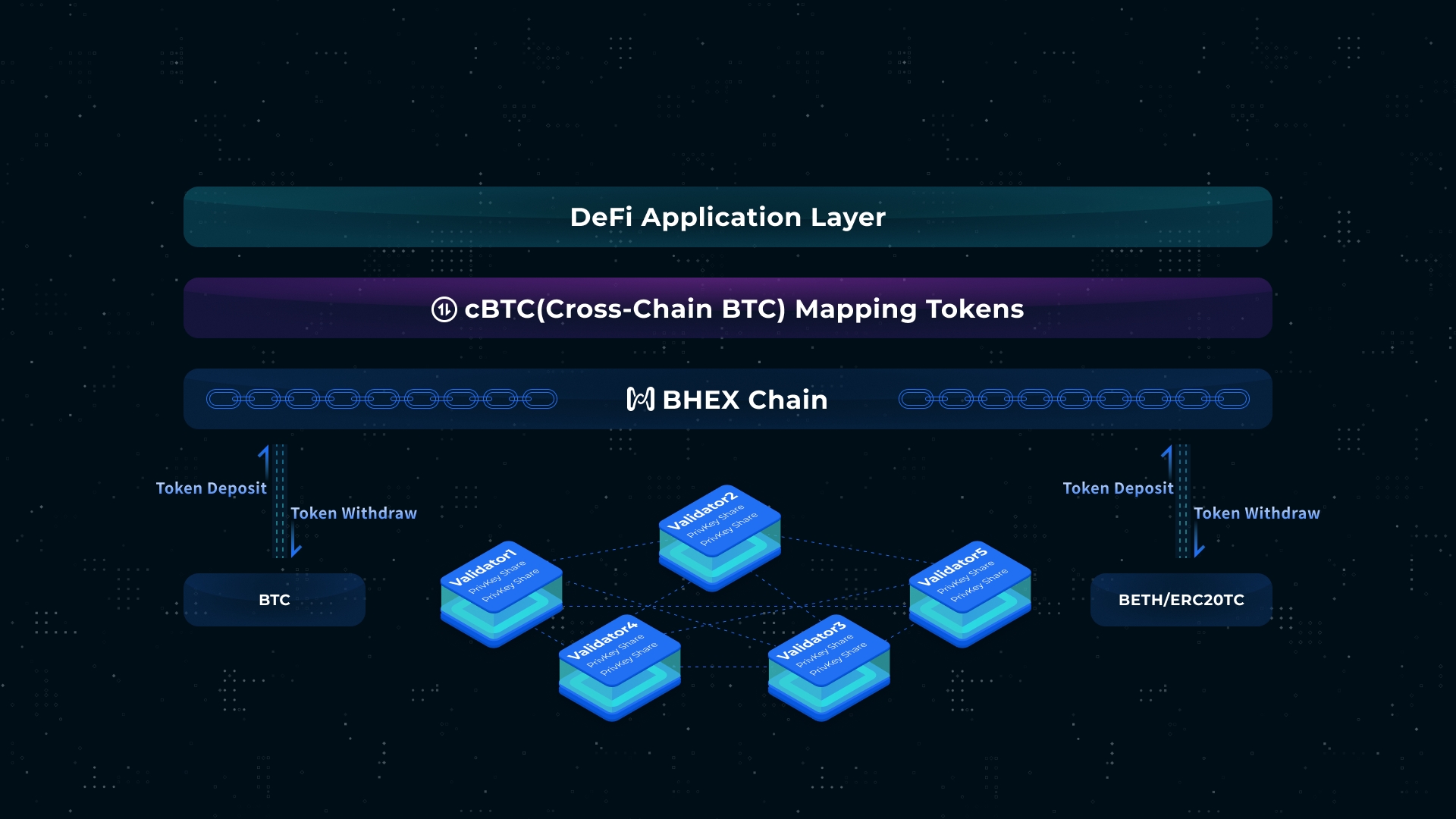

Bluehelix has adopted cryptographic technology-based cross-chain support, combined with cryptographic tools such as elliptic curve digital signatures, zero-knowledge proofs, and trusted multi-party computing, to achieve the cross-chain private keys custody and the distributed private key generation and signatures on all core nodes. In the whole process, the private key is completely invisible and never actually appeared, but is kept in the form of fragments on different core nodes. This ensures that the generation of the private keys are completely decentralized, no parties can obtain the entire private keys, thereby achieving safe and reliable custody and cross-chain asset management technology.

Bluehelix supports the N*N cross-chain model and supports the data interoperability among the public chains. Starting from cryptography, Bluehelix is compatible with all current mainstream public chains, and at the same time, it is also compatible with all current mainstream cross-chain schemes.

Bluehelix Functions and Application Scenarios:

Cross-Chain Token Deposits and Token Withdraw:

Bluehelix cross-chain deposit and withdrawal, based on distributed cryptography technology, the deposit address of any user is generated by cross-chain custody nodes in a decentralized manner, and each user holds an independent address. After the address is generated, the user can deposit the corresponding token to the corresponding custody address in any way. Users can also withdraw their tokens at any time. The overall process is very simple and convenient, and will not leak any privacy of users. At the same time, users can choose to deposit or withdraw tokens from exchanges, wallets, commands, etc.

During the deposit and withdrawal process, user assets are locked 1:1, and user assets cannot be inflated or deflated on the chain. The confirmation speed of the entire deposit and withdrawal transaction is basically the same as that of the centralized exchange, which depends on the consensus efficiency of the corresponding public chain. In the meantime, the overall deposit and withdrawal fees depend entirely on the fee mechanisms of the corresponding chain. Bluehelix does not charge any fees. To a certain extent, the fees are much lower than that of centralized exchanges. The overall deposit and withdrawal process is similar to Renvm. Compared with Renvm, Bluehelix has the following features:

1. Lower cross-chain deposit and withdrawal fees, zero additional minting and withdrawal fees

2. Support more asset types in deposit and withdrawal

3. A more secure and transparent mechanism, all cross-chain custody nodes and custody operation accounts are completely transparent, and transactions are fully traceable

Cross-Chain

Composability & Migration of Cross-chain assets (cross-chain version of Curve)

Bluehelix supports the decentralized access of most mainstream public chains, and has made many innovations. It supports the mapping of multiple assets into the same asset, which greatly enriches assets categories, the composability of assets and the utilization efficiency of assets.

For example, on Bluehelix, USDT on ETH/HECO/BSC/TRON can be mapped to the same kind of USDT. As long as users hold USDT deposits on any public chain, they can decentralize withdrawal from another public chain. USDT, if the user deposits BEP20-USDT, AND he/she can withdraw USDT from any chain of HECO/ETH/TRON, provided that sufficient USDT is custodian on these chains.

In this way, it is very convenient to complete the cross-chain migration of the same type of assets, which can be applied in digital assets linking and management for many multi-chain deployments of DeFi applications. Bluehelix will also support more public chain access in the future. To a certain extent, this can be compared to a cross-chain version of Curve, which can do a 1:1 swap of cross-chain assets.

HDEX: Full Cross-Chain Dex, The Cross-Chain version of UniSwap

In comparison to Uniswap and other public chains DEX, HDEX has the following unique points:

Firstly, HDEX supports native token swap, users can be directly converted to BTC, DOGE, and other mainstream public chain original tokens via HDEX and withdraw to their wallets at any time. Different from cross-chain assets such as BTC on the ETH/BSC/HECO chain, it relies more on the Wrapped Token issued by a centralized organization. The credit risk of the asset depends on the issuing organization. It is not the BTC chain. At the same time, the overall exchange process is also centralized.

Second, HDEX supports cross-chain asset combination, which can combine multiple chains of similar assets and map them into one asset, which greatly improves the utilization rate of assets and supports more choices and liquidity construction for users. For example, if a user holds USDT on any chain, the deposit to HDEX will be mapped to the same USDT, which is very convenient for users to use any of their assets on the chain.

Third, the HDEX decentralized exchange supports both AMM and Orderbook models. Users can initiate market order or limit order transactions, set bid and ask orders at the target price, and realize automatic execution, instead of relying solely on AMM. At the same time, this also makes it easier for users to gather assets near the transaction price, which significantly enhances fund utilization. Furthermore, HDEX is also very convenient and compatible with CEX user habits and user experience, which can improve and help CEX users seamlessly switch to DEX.

Forth, more than 2000 TPS and second-level consensus confirm efficiency, delivering ultimate performance, while HDEX's incredibly low Gas fee is less than 2.5% of ETH.

Fifth, it is not higher than the transaction fees of centralized exchanges, and is cheaper than most current DEX transaction fees.

Sixth, It supports the OpenDEX protocol, which allows any individual or community to develop their own DEX using the OpenDEX protocol. At the same time, not only can it achieve liquidity sharing and co-construction between all DEX based on the agreement on the chain, but also support individual DEX personalization, which can greatly improve liquidity and increase transaction activity.

Seventh, HDEX provides a comprehensive API to facilitate connection with major exchanges, which can effectively solve the problem of impermanent loss faced by liquidity providers.

Lastly, all listing on HDEX requires HBC holders to vote before they can trade cross-chains on HDEX, which completely eliminates the problem of fake assets.

Cross-Chain Asset 1:1 Mapping

Users can utilize Bluehelix to achieve any public chain assets interoperability in a fully decentralized, safe ,and economically friendly way, through decentralized multi-chain interoperability and circulation, the ecology system construction of the corresponding public chain will prosper.

Let us take the mapping of BTC to ETH as an example (cBTC), the process is as below::

1. The user deploys a smart contract on Ethereum and issues 10,000 cBTC.

2. Deposit 10,000 cBTC into Bluehelix and initiate a BTC-cBTC asset mapping proposal (mainly to check the security of smart contracts). After the proposal is approved, a BTC-cBTC asset mapping pair will be created and all cBTC will be locked;

3. The user re-deposits 10 BTC into the custody address on Bluehelix, and swaps 10 cBTC through the mapping pair;

4. Withdraw 10 cBTC to the Ethereum smart contract, then there are 10 cBTC in circulation (completely 1:1 match with BTC);

5. The user can swap from Ethereum network to cBTC and then re-deposit to Bluehelix network, map and swap for BTCs, and then withdraw BTCs to his BTC wallet address

In this way, Bluehelix can easily bring an asset into any public chain, realizing complete cross-chain interoperability. It can guarantee the complete 1:1 locking of assets, will not bring any fictitious assets, and achieve the completed privacy protection. Anyone can bring their assets into the public chain that needs to be crossed, and can easily realize asset cross-chain bridges, and truly promote the development of the DeFi ecosystem. To a certain extent, this makes the number of decentralized assets on Ethereum no less than the number of assets on centralized exchanges, and it may surpass in the future.

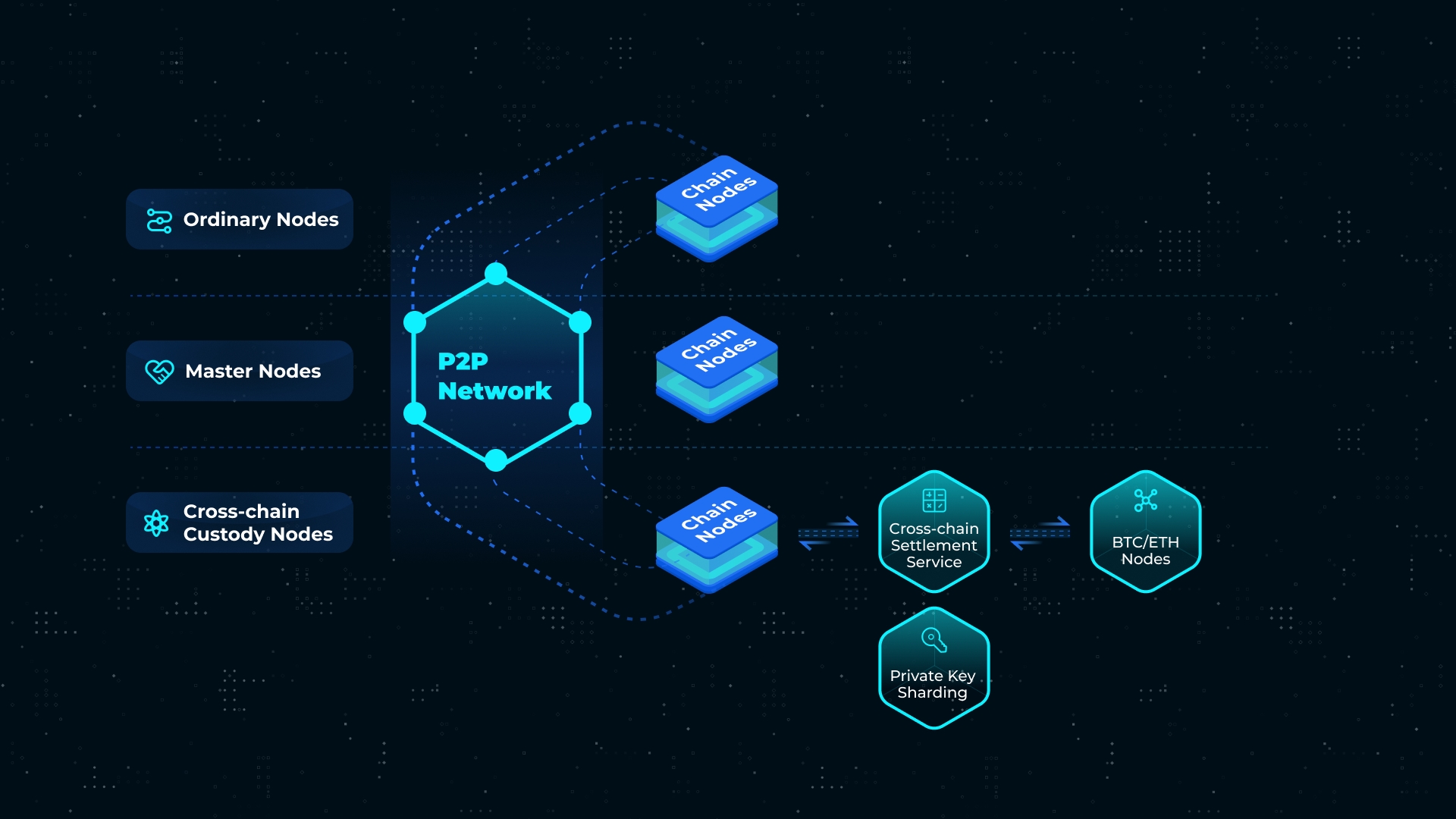

Innovative Node Architecture: Multi-Layer Nodes Model

Bluehelix can realize the safe cross-chain of any asset very simply and conveniently. It adopts a patented decentralized Bluehelix private key sharding technology, and manages the private keys through the joint collaboration and consensus of validation nodes, thereby achieving safe and reliable custody and cross-chain asset management technology.

Because the more nodes supported by the cross-chain private key sharding technology, the lower the overall generation and signature efficiency. , Based on security, community consensus, efficiency and other aspects, Bluehelix innovatively implements a three-layer node model:

Ordinary Nodes: Any user can access it to view blockchain related data and send related protocol data

Consensus Nodes: Any node that reaches a certain pledge rate can participate in the overall consensus mining, and the number in the early stage is about 35.

Cross-chain Custody Nodes: Holding the private key sharding of the custody unit, the cross-chain custody nodes and the settlement program need to be deployed separately, and the core nodes are responsible for the communications with the heterogeneous chain and have to equip themselves with an excessive pledge from creditable institutions and a more comprehensive rewards and punishment mechanism. At the same time, cross-chain custody nodes can also participate in consensus and block production-related work, the number of which is about 15 in the early stage.

Consensus nodes and Custody nodes adopt a rotation mechanism. In terms of deployment, clearing services need strict segregation (not open to the public network at all) and guaranteed security to prevent the leakage of private key shardings. At the same time, Bluehelix will monitor any abnormal deposits to ensure that only healthy assets circulated in the chain. Through the three-layer node architecture, Bluehelix has achieved security, community consensus, and is on the way to expansive ecology prosperity.

Future prospect

Bluehelix can completely solve the problem of the safe circulation of decentralized assets. As an ecological builder, we want more communities to build a variety of ecological structures on the Bluehelix underlying asset platform, hence smart contract support is essential. The future Bluehelix will enable WASM and EVM dual virtual machines at the smart contract level, allowing for quick and efficient migrant existing projects and additional application development on Bluehelix.

As the public chain of DeFi's underlying ecological facilities, Bluehelix will actively cooperate with the community, exchange, and public chain to construct links, work together to advance DeFi's ecological growth, do an excellent job of promoting the various partners, further promote the prosperity of DeFi, and achieve the vision and aspirations of digital assets.

Last updated